Today’s a big day for Virtual Power Plants (VPPs): a federal rebate for VPP-capable batteries is coming online, while two states are offering incentives that require joining one. So why are multiple layers of government teaming up to tempt you into handing over control of your battery to a VPP operator, and should you take the bait?

July 1 alters the economics of home batteries and VPPs in ways I’d only ever dreamed of in the past. The federal battery rebate is bursting onto the scene and making home batteries almost a must-have for millions of households. If your home is connected to the grid, batteries capable of VPP participation are required to get the rebate, but you don’t have to actually join one.

The WA government has gone a step further with its own battery rebate launching today, that insists West Australians bite the bullet and join a VPP if they want to cash in on the state-backed discount.

Meanwhile, the NSW government is ditching its battery rebate entirely and replacing it with a redesigned incentive for joining a VPP, which also kicks in from today.

Do All These Government Incentives Mean VPPs Are Worth It?

Thanks to all these developments, many newly minted battery owners will soon be asking themselves, “Should I join a VPP?”

I say: Yes!

Most households should lash their batteries to a VPP and benefit from the provided payments because they’re worth the minor drawbacks — or at least they are, provided you’ve done your homework and joined a decent one.

VPP payments aren’t great, and their net benefit is likely to be around $200 or less per year. But it adds up, and as most people won’t even notice they’re part of a VPP, it’s not bad for doing next to nothing.

Below I’ll cover the main benefit of joining a VPP — which is money — and give a rough estimate of how much joining one is likely to save you and how it may affect battery payback periods.

What’s a VPP Anyway?

If you join a VPP, your battery will occasionally be used to support the grid. In return, you’ll receive modest but still worthwhile payments. This is all for the good because it lowers the cost of running the grid, which lowers electricity prices for everyone, and it helps the country close down coal power plants. Exactly how your battery is used to support the grid and how often depends on the VPP (read a more detailed explainer on how they work here).

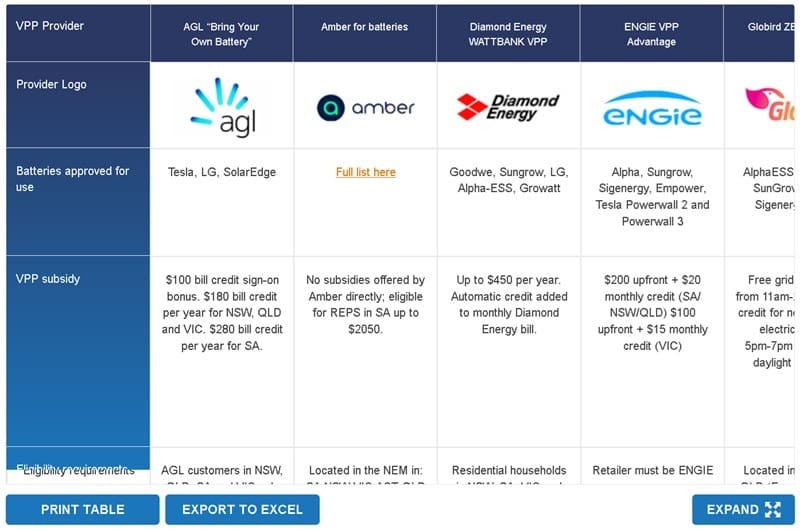

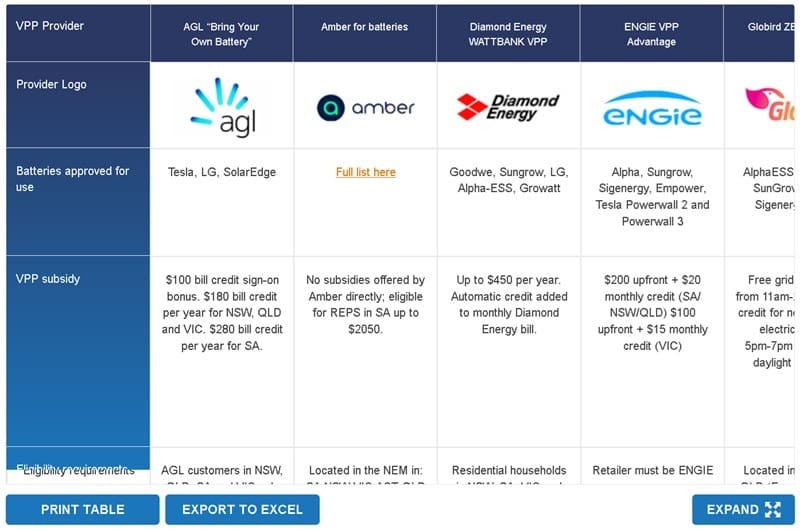

For information on the current state of VPPs, you can use our VPP Comparison Table. Alternatively, you could just look at the image of it I’ve put below, but that’s kind of dumb when you can click through to the real thing.

While we try to keep our VPP Comparison Table up to date, it’s a rapidly changing field, so we can’t guarantee it will always be spot on.

NSW’s VPP Payment

Update 4:26pm July 1 2025: VPP payment adjusted to match current ranges given by NSW government.

In NSW, there’s a payment for joining a VPP that’s expected to be around $40-$55 per usable kWh of battery capacity. So, for a 15kWh battery, it would be $600-$825. This payment can only be received if the battery has 2-28kWh of usable capacity, and so could range from as little as $80 to as much as $1,540. Because it represents a decent amount of money for a typical battery, joining a VPP should make sense to sensible NSW battery owners.

WA Battery Rebate Requires A VPP

WA has Australia’s only state-level battery rebate, and its coolest feature is that it can be combined with the federal battery rebate, making home batteries in WA nearly a no-brainer. But it has the condition that you must join a VPP. This basically makes the WA state rebate one big VPP incentive. And it is pretty big. In the southwest Synergy area, it’s worth $130 per usable kWh of battery capacity, up to a maximum of $1,300. But in regional areas, it’s $380 per usable kWh, up to a maximum of $3,800.

While there’s an existing VPP in WA, new state-provided VPPs will likely be the most popular. The one available to the most people is the Synergy Battery Rewards VPP. This promises to discharge your battery to the grid no more than 30 times per year in return for 70c per kWh discharged. The VPP also promises you won’t be out of pocket for the energy used, which is better than some VPPs.

In the example they give, a battery is drained of 90% of its full usable capacity. If this is done 30 times a year for a 15kWh battery, then the maximum VPP payment would come to $284. Even if you allow 10c per kWh for wear and tear, that’s still $243 per year. While there’s no guarantee your battery will be drained by 90% a total of 30 times a year, it does look like WA VPPs will provide a reasonable payment in comparison to eastern state VPPs. Considering how badly Western Australians have been screwed over when it comes to electricity over the years, this is surprising.

VPP Payment Estimates By State

To get a rough estimate of how much you may save in different states by joining a VPP, I’ve assumed signing up will save $200 a year. I’ve also averaged the NSW VPP payment and the WA state battery rebate out over 10 years, which is the minimum amount of time a decent quality battery should last. This gives the following estimates for a 15kWh battery:

- NSW: $270 annually or $2,700 over 10 years

- NT: nothing currently

- QLD: $200 annually or $2,000 over 10 years

- SA: $200 annually or $2,000 over 10 years

- TAS: nothing currently

- VIC: $200 annually or $2,000 over 10 years

- WA: $330 annually or $3,300 over 10 years

So if you pay $10,000 for your battery, over 10 years VPP payments will — hopefully — cover at least 20% of its cost in most states and considerably more in NSW and WA.

VPPs & Battery Payback Periods

Joining a VPP can significantly reduce battery payback periods. But by just how much is difficult to pin down, as battery payback times are affected by battery cost, household consumption patterns, electricity prices, solar feed-in tariffs, and solar system size.

To give an idea of how VPPs can affect payback periods, I’ve put a rough estimate of the simple payback time for a typical household that installs a 15kWh battery that costs $10,000 in each capital city. The simple payback time is how long it takes for savings and/or credit on electricity bills to equal the installed cost of the battery. I’ve then given the simple payback period with VPP payments of $200 per year. The effects of the NSW VPP payment and the WA battery rebate are included. While no VPPs are currently available in TAS or NT, because this could change, I’ve assumed VPPs that pay $200 per year become available there:

| Annual Savings and Simple Payback Periods for $10,000 15kWh Battery With & Without VPP Payments | ||

|---|---|---|

| Capitals | Without VPP | With VPP |

| Adelaide ($200/year VPP) | 7.6 years | 6.6 years |

| Brisbane ($200/year VPP) | 9.3 years | 7.9 years |

| Canberra ($200/year VPP) | 14.7 years | 11.4 years |

| Darwin ($200/year VPP) | 17.9 years | 13.2 years |

| Hobart ($200/year VPP) | 27.4 years | 17.7 years |

| Melbourne ($200/year VPP) | 14.1 years | 11 years |

| Perth ($200/year VPP) | 8.9 years | 7.1 years |

| Sydney ($200/year VPP) | 9.3 years | 7.3 years |

With the above estimates, joining a VPP will knock a minimum of one year off battery simple payback periods in every capital. The largest reduction occurs in Hobart, where joining a VPP knocks nearly 10 years off that city’s excessively long simple payback time. Where batteries already provide a good return, VPPs improve it, and they can make batteries worthwhile in locations such as Canberra and Melbourne, where payback periods might otherwise be considered too long.

Who Shouldn’t Join A VPP?

There are a few people who probably shouldn’t join a VPP. They may be of no interest to people who are determined to maintain complete control over their batteries and who either can’t join or couldn’t be bothered with the couple that leave you in full control of discharging.

Also, those who place very high value on having backup power may not want to join a VPP because of the small risk of it draining their battery just before a blackout. But these people should first consider if joining a VPP would allow them to buy a bigger battery and improve their overall ability to power through blackouts.

There may also be people who just don’t consider VPP payments high enough to be worth the effort of joining. But if money is not enough to motivate you, because joining a VPP will improve the grid’s ability to integrate renewable energy and hasten the closure of coal power stations, so the environmental benefit may provide you with enough incentive to sign up.

VPPs Are Worthwhile

While VPPs don’t pay as much as I’d like and choice is limited, they pay enough to be worthwhile. While they’re making you modest amounts of money, they also help the country quit fossil fuels, so they’re all for the good. Provided a non-terrible VPP is available that accepts your battery is available, I definitely recommend giving it a go. In NSW and WA, not joining one really only makes sense if you don’t like money.

If you’re still uncertain and want more detail about the issues some VPP schemes present, I’ll be going into more detail about these in a follow-up article next week. Sign up to our free weekly newsletter to ensure you get to read it.

In the meantime, read up on the fine print on the VPP-linked federal and state battery incentives launching today in our comprehensive explainer.