The global industrial robot market has declined since the COVID-19 pandemic, Interact Analysis reported. Source: Interact Analysis

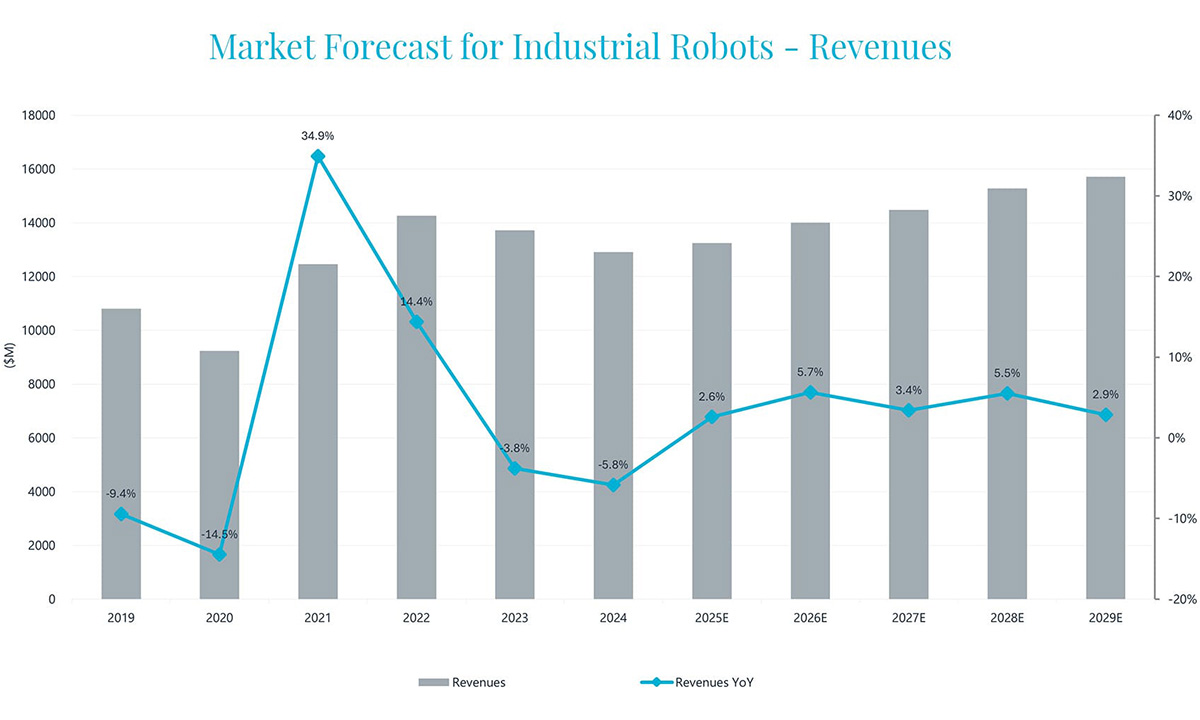

The 2023 slump in the global industrial robot industry continued through 2024, with sales revenue declining 5.8% year over year, according to Interact Analysis. The market research firm attributed this decline to slow demand caused by a dip in manufacturing activity over the year, coupled with a decrease in average prices.

“In 2024, the industrial robot market continued its decline from the 2023 slump,” stated Samantha Mou, a research analyst at Interact Analysis.

The global shipment volume of industrial robots in 2024 totaled just over 505,000 units, reflecting a 2.4% decrease compared with 2023. This reduction in shipments was coupled with a decrease in average prices, she said.

The manufacturing industry faced a challenging year in 2024, as high interest rates in Western markets and subdued demand in Asia slowed investment in production across all major regions, noted Interact Analysis. In addition, fierce competition within the industrial robot market squeezed margins for robot manufacturers, and many emerging brands sacrificed profitability for market share, it said.

With rising production volumes and intensifying competition, the average revenue per unit (ARPU) of industrial robots declined significantly – from around $31,100 in 2018 to $25,600 in 2024. While there was a temporary price surge in 2022 amid the global supply chain crisis, prices resumed their downward trend in 2023 as demand cooled and competition increased, said Interact Analysis.

In 2024, ARPU fell more sharply than in previous years, dropping by 3.6% due to easing inflation and growing competition. Interact Analysis last week again reduced its forecast for mobile robot shipments.

Industrial robot revenue has fallen in the past three years. Source: Interact Analysis

Industrial robot demand varied across regions, industries

While the overall industrial robot market declined in 2024, performance across major regions varied, Interact Analysis explained. With a higher concentration of vendors and large order volumes leading to robot prices lower than other major regions, the Asia-Pacific (APAC) region dominated the global market despite a drop of 1.1% in shipments.

The research firm predicted that the APAC region will continue to grow steadily over time as demand for robots increases, while the Americas region declined 3.7% but could maintain its market position, buoyed by U.S. reshoring initiatives and the growing potential of Latin America.

Interact Analysis’ long-term view for Europe, the Middle East, and Africa (EMEA) was not as positive, with the industrial robot market declining by 8.1% and projected to grow at a slower compound annual growth rate (CAGR) in comparison with the other two regions over the next five years. Nevertheless, EMEA will continue to be the second-largest market for industrial robots, it said.

In terms of industry-specific performance, the automotive industry struggled in 2024 and demand for industrial robots also decreased in general manufacturing such as electronics, metals, and plastics and rubber. However, Interact Analysis found that industrial robot demand in consumer-related industries, including food and beverage and life sciences industries, showed more resilience.

APAC remains the largest market for industrial robots by far. Source: Interact Analysis

Interact Analysis sees signs of a rebound

There are signs that macroeconomies may slowly emerge from recession, which will result in the industrial robot industry gradually recovering this year and next, said Interact Analysis. However, Europe could continue to lag over the coming years, following a market contraction of 8.1% in 2024.

“We anticipate a gradual recovery of the robotics market across all three major regions in 2025, with stronger growth expected in 2026,” said Mou. “In the Americas and Asia, market sentiment is showing signs of improvement, and there are encouraging indications that the macroeconomy may slowly emerge from the recession.”

According to the Japan Robot Association (JARA), orders for manipulators and robots rose 32.2% in Q1 2025, with export shipment value increasing by 22.8%. Japanese robot vendors, which accounted for 47% of global robot revenue in 2024, are often seen as reliable indicators of broader market health, said Interact Analysis.

In this context, global shipments of industrial robots are projected to grow by 5% in 2025. However, due to continued downward pressure on average prices, revenue growth is expected to be more modest, at just 2.6%.

Since the second half of 2024, monthly indicators for the industrial sector in both the U.S. and China have shown signs of recovery, reported Interact Analysis. Although tariff uncertainties pose risks to machinery orders in the second half of 2025, current demand trends in major regions suggest they will not lead to a market-wide contraction, the firm forecast.

“However, in Europe, recovery signs remain weak, and our growth forecast for the EMEA region remains the lowest,” she acknowledged. ” Despite this, we expect the broader manufacturing sector in Europe to benefit from the global economic cycle.”

China, the U.S., and Germany show early signs of a robotics rebound, says Interact Analysis.

About the industrial robot report

Interact Analysis said its latest report includes market size and forecast data for industrial robots with detailed segmentations in both revenue and shipment terms, five-year forecasts to 2029, and key trend and market driver discussion and analysis provided by robot type, payload, industry and application.

With over 200 years of combined experience among its team, Interact Analysis provides market intelligence for global supply chain automation. The company, which has offices in the U.K., the U.S., and China, said its research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods.

“The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth,” said the firm.